Send money to Mali from Italy

Fast, low-cost and secure online money transfers to Mali from Italy. Choose a receive method, pay for your transfer and keep track of your money.

Sending from the US? Open a Sendwave Wallet for faster transfers, better rates and more control for your recipient.

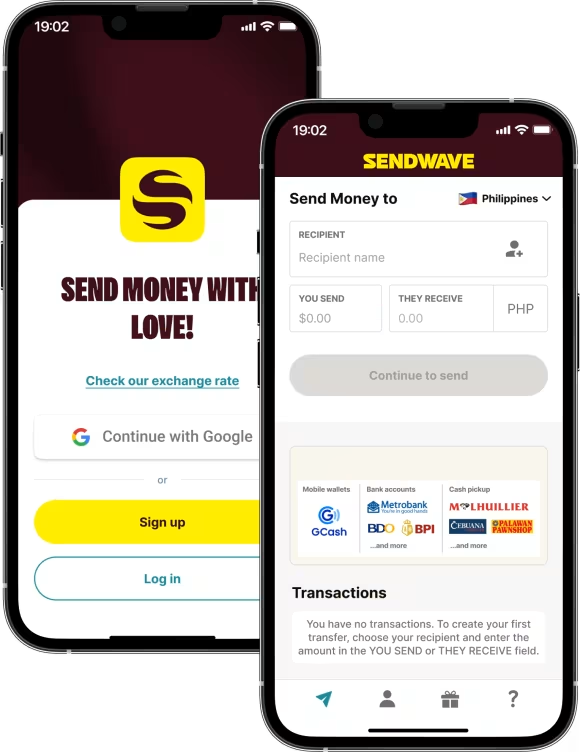

Scan this QR code with your phone to download our app!

Exchange Rate

1 = 0

Send money to your loved ones

We make sure more of your money goes to those you love, not to high service fees

You send

They get

Easy to sign up

Link your debit card, verify your identity and be sending in minutes.

24/7 support

We are available to chat 24/7 if you need any help.

Fast & convenient money transfers

Skip the line and send money from your phone to your loved ones in seconds.

Trusted and legitimate

Trusted by over 1 million users, Sendwave is operated by Zepz. and is authorized to transmit money in the US, Canada, the UK and the EU.

All-in-one wallet

A new way to send money and support loved ones from the US with more value and control. Wallet is only available for US senders right now, but more countries are coming soon.

Our Story

At Sendwave, we're on a mission: to make sure your money gets to your friends and family, as safely and effortlessly as possible.

Our Story